Monetary policy is an ‘action that a country’s central bank or government can take to influence how much money is in the economy and how much it costs to borrow’ (Bank of England, 2024). This can be achieved through the manipulation of interest rates (the most common), open-market operations, reserve requirements or quantitative easing. The Bank of England is responsible for utilising monetary policy in the UK. This is an important mechanism as it can help the government achieve its macroeconomic objectives which include stable economic growth and price stability.

This article will discus the primary tools of monetary policy and their effects on macroeconomic objectives. It will reference key case studies from the past and evaluate the limitations of monetary policy.

Monetary Policy Tools and Their Effects

Interest Rates

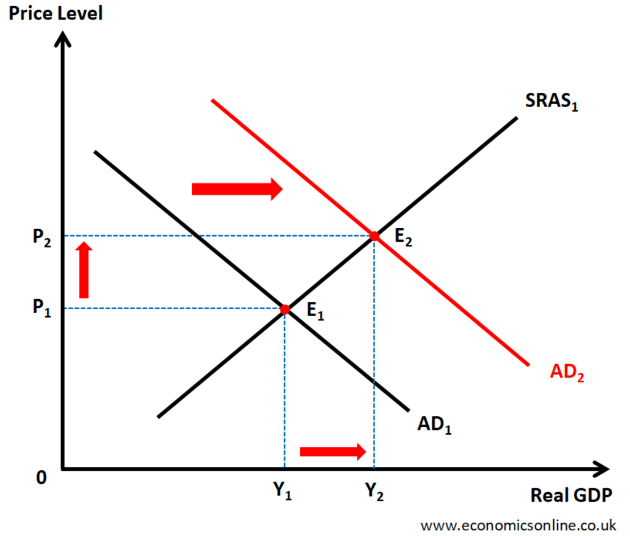

The interest rate is the cost of borrowing or the reward for saving. The rate can be altered to incentivise one over the other. Lower interest rates mean consumers and firms can borrow more easily. This results in consumers spending more on goods and services and firms investing more in capital and machinery. Consumption and investment are components of aggregate demand, so a reduction in interest rates will shift aggregate demand to the right. This will result in economic growth. The improvement in capital may also increase the productive capacity of the economy, increasing long-run aggregate supply. Higher spending in the economy provides an upward pressure on the price level (inflation). Interest rates are shown as a percentage of the amount you borrow or save over a year.

In the UK, the Monetary Policy Committee, of the Bank of England, set the bank rate to meet the government’s target of a 2% inflation rate (Bank of England, 2024). The bank rate affects the interest rates which commercial backs charge to consumers. These commercial banks cover their costs by earning more interest from borrowers than they give to savers, so the change in the bank rate will not be the same as the resulting change in interest rates set by commercial banks. The bank rate affects people with variable-rate mortgages more because they have to pay higher monthly mortgage repayments as well if the bank rate rises.

Open Market Operations

Open market operations are another tool used to regulate the money supply. Central banks can buy securities from commercial banks or other financial institutions. When they do this, the money supply increases and short-term interest rates reduce. This usually occurs during economic slowdowns or recessions. The central bank can also sell securities. This reduces the money supply and decreases borrowing. This helps to control inflation. These short-term operations are important because they manage liquidity fluctuations in the banking system. Liquidity refers to how much cash banks have, on hand, to meet the short-term needs of economic agents.

Quantitative easing is a long-term open market operation which is less often used than its short-term counterparts. It was utilised after the 2008 Financial Crash and Covid 19 to stimulate economic activity. To do this, the central bank buys bonds, or other financial assets, from banks and this results in the money supply increasing. The purchasing of bonds increases their prices. When this happens, the fixed interest of the bond is spread over a higher price, so yields (interest rates) fall. Lower interest costs make it easier for consumers to spend on goods and services and for firms to invest. This increases aggregate demand and confidence in the economy. Quantitative tightening is the opposite and is used to reduce inflation.

Reserve Requirements

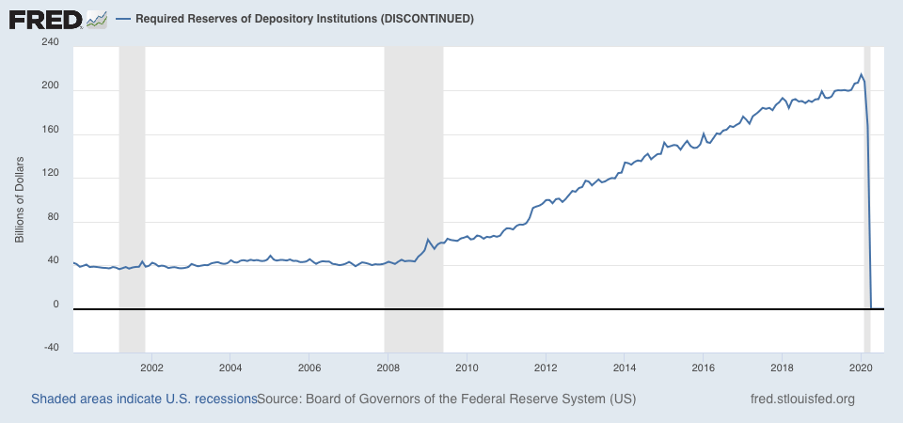

Reserve requirements are the minimum amount of money commercial banks are required to hold. This money is not available for lending but is kept in reserve to ensure that banks have enough liquidity to meet customers’ borrowing demands. For every deposit made into a bank, the bank must set aside a certain percentage of it as reserves. Higher reserve requirements reduce the available money supply because banks are able to lend less. This reduces economic activity and nominal GDP and pushes down price levels. The opposite can be said for lower reserve requirements. The European Central Bank currently has a reserve requirement of 1% (CEIC, 2024) which commercial banks in the Eurozone must adhere to. This requirement supports economic activity. Some countries, including the UK, Canada and Australia, do not have reserve requirements. Instead, they use other tools of monetary policy.

Case Studies: Monetary Policy in Action

2008 Financial Crash

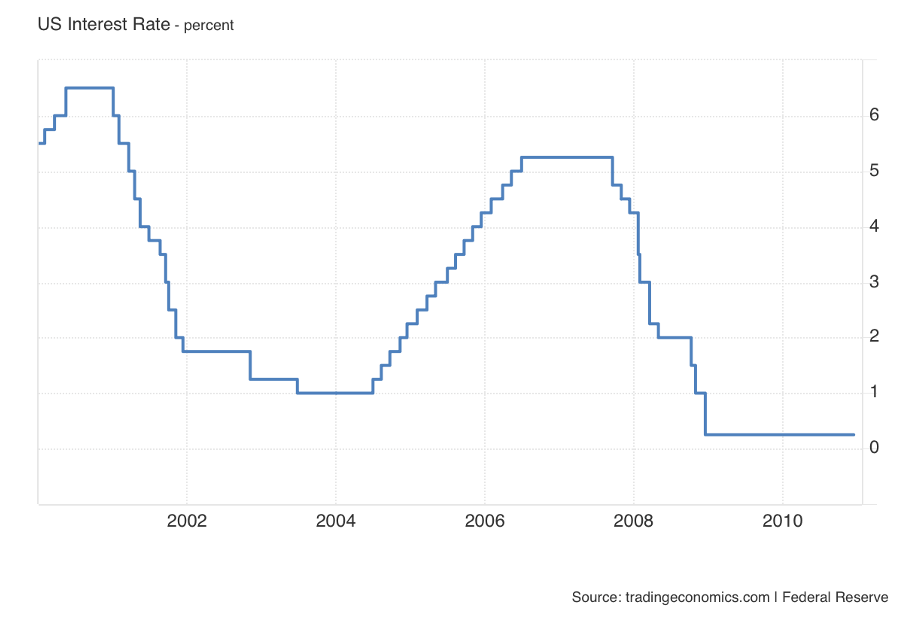

The 2008 Financial crash was a significant event during the Great Recession, which cost many people their jobs and houses. The root of the issue was expansionary monetary policy in, in the form of exceptionally low interest rates in the US. The Federal Reserve implemented this to increase aggregate demand because consumers had lost confidence after the 9/11 terrorist attacks and corporate accounting scandals. The Federal Funds Rate was reduced from 6.5% in May 2000 (Board of Governors of the Federal Reserve System, 2013) to 1% in June 2003 (Board of Governors of the Federal Reserve System, 2024). Although this policy was effective in the short-term, it carried some long-term risks because consumers and firms became over-reliant on borrowing to fuel their spending. Consumers were able to borrow easily and took up debt they could not afford which led to house prices rising unsustainably, known as a housing price bubble. This policy did indeed stimulate economic growth – people were able to borrow more easily so bought more goods and services. People also bought high value goods, for example houses. This resulted in house prices rising unsustainably, creating a housing price bubble.

Eventually, house prices stopped rising because fewer people were willing and able to pay the higher prices. Mortgage borrowing also slowed. To reduce the excessive borrowing, and inflation, the Fed began to increase the Federal Reserve Rate in June 2004. Two years later, the rate reached 5.25%, where it remained until September 2007 (Board of Governors of the Federal Reserve System, 2024). In 2006, house prices began to fall. This was catastrophic for many Americans because their homes were worth less than what they had originally paid for them. This meant they could not sell without still owing money to their lenders. This highlighted the lack of adequate oversight of subprime lending practices. At this point, subprime lenders then began filing for bankruptcy. The issue spread beyond the border of the US, when Northern Rock approached the Bank of England for emergency funding to keep operating, displaying the global interconnectivity of financial markets. The Fed began to steadily cut rates after September 2007. However, the US economy was still deeply in a recession in 2008. To stimulate economic growth, the Fed cut the interest rate by 0.75%, its biggest cut in a quarter century, which they did this 3 times that year (Board of Governors of the Federal Reserve System, 2024). Lehman Brothers collapsed in September and was the largest bankruptcy in US history, displaying the sheer devastation of the global financial crisis (House of Representatives, 2008). The collapse of the Lehman Brothers was a signal to governments worldwide to stabilise their economies by improving regulation of financial markets.

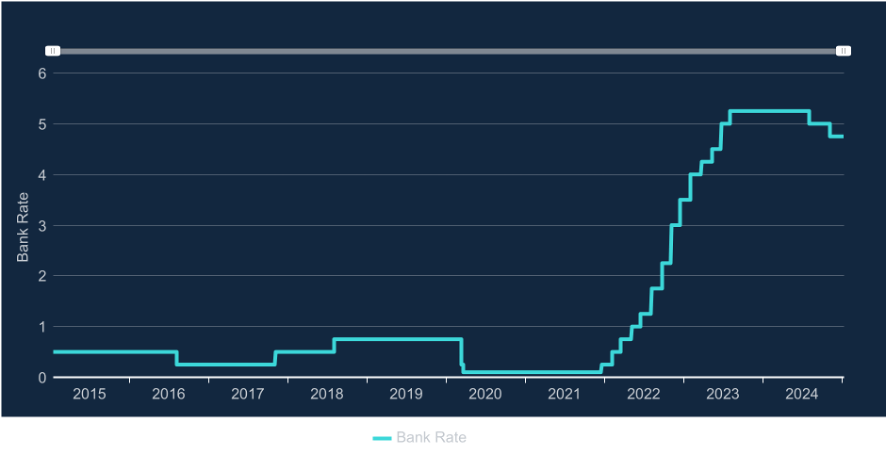

The Wall Street Bailout package contained measures, such as financial lifelines for some subprime lenders, which helped jumpstart the economy. In December 2008, US interest rates were at 0-0.25% and remained there until 2015 (Board of Governors of the Federal Reserve System, 2024). This decentivised saving and promoted borrowing. This fulfilled the aim of increasing aggregate demand and growing the economy. In the UK, interest rate followed a similar trend – interest rates reached a high of 5.75% in October 2007 and gradually reduced to 0.5% in February 2009 (Bank of England, 2024). The 2008 Financial Crash highlighted that while monetary policy can be an effective short-term response to crisis, it can be undermined by structural vulnerabilities in the economy.

COVID-19

COVID 19 caused widespread lockdowns which resulted in less spending by households and the closure of many businesses. To combat this, the UK reduced interest rates to 0.1% (Bank of England, 2023). This reduction incentivised borrowing by consumers and firms, with the aim to stimulate economic growth and increase nominal GDP. Firms were able to borrow to cover revenue shortages; as a result, they were able to remain operational during lockdown and prevent mass layoffs of workers. As well as reducing interest rates, the US set their reserve requirements to 0%, in March 2020 (Board of Governors of the Federal Reserve System, 2024), to increase the money supply and stimulate economic growth. It has stayed at 0% since.

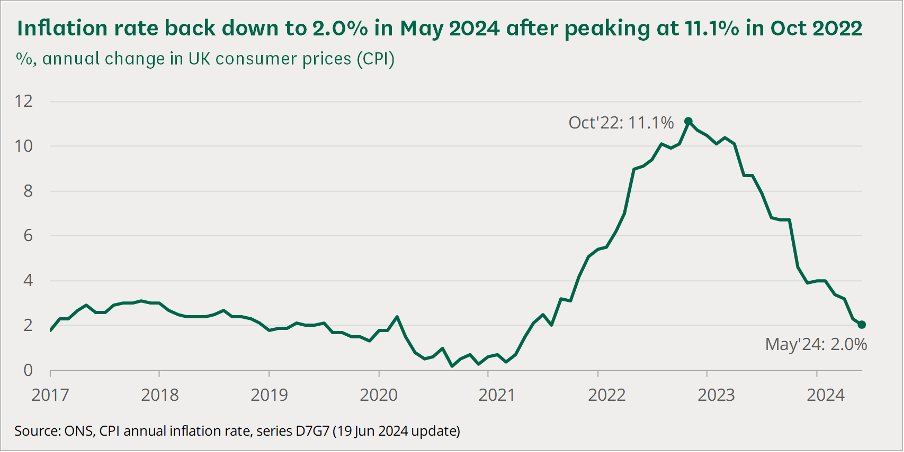

The pandemic disrupted supply chains and caused delays, resulting in shortages of certain goods and higher costs. This was exacerbated by barriers to trade, such as paperwork, introduced when the UK left the EU’s single market at the start of 2021 (European Parliament, 2024). Energy costs soared after lockdown eased due to the increased demand, and further amplified by the Russia-Ukraine war. These factors contributed to inflation rising almost continuously from under 1% to 11.1%, measured by CPI, from early 2021 to October 2022 (UK Parliament, 2024). Although the initial monetary policy response dampened the economic turndown, it also contributed to inflationary pressures when the supply side issues surfaced, decreased the productive capacity of the economy. This highlights the challenge central banks face in balancing short-term spending stimuli with long-term control of inflation.

To combat this, deflationary monetary policy was utilised. These measures began in December 2021, when interest rates were first increased. Rates peaked at 5.25% in August 2023 (Bank of England, 2024), where they remained until July 2024. These measures reduced inflation but this came at the opportunity cost of potentially slowing down recovery, because higher borrowing costs would discourage spending and limit economic growth. The pandemic displayed how economic growth and inflation are intertwined, as well as the challenges in managing them simultaneously. It also showed how supply chain disruptions and geopolitical events can complicate the effectiveness of monetary policy.

Limitations of Monetary Policy

Despite having been very effective in maintaining economic stability in the past, monetary policy has some drawbacks. Below are some of this policy’s key limitations:

1 . Time lag

The effect of a change in interest rates takes time to filter through the economy. This is because households and businesses need time to make decisions and change their spending behaviour. These decisions may require the consideration of opportunity costs to determine the best possible purchase

When aggregate demand increases, a a result of expansionary monetary policy, firms need time to adjust their output. If the economy is already producing at productive capacity, more workers or capital may need to be employed to be produce more goods and services. Hiring workers and engaging in investment projects takes time. Hence, the full effect of monetary policy may only be seen between one and two years after it is first implemented (Reserve Bank of Australia, n.d)

2. Lack of targeting

Monetary policy primarily uses interest rates to affect economic activity. Changing interest rates are felt by everyone in the economy, hence this policy cannot target particular sectors of the economy that are experiencing structural issues. This may result in industries not needing a stimulus feeling effects. For instance, lower interest rates will benefit high-value consumer goods sectors but will have little effect on education or healthcare sectors, which are less sensitive to changes in borrowing costs.

3. Business and consumer confidence

If economic agents are not sure about the future situation of the economy, they are less likely to utilise the reduced interest rates or respond to the increase in monetary supply via quantitative easing. This uncertainty is more pronounced for expansionary monetary policy, than for contractionary policy, as households and firms are less likely to increase consumption or investment in times of economic uncertainty. This was evident in the 2008 Financial Crash and the COVID-19 pandemic, highlighting that without business and consumer confidence, monetary policy struggles to make an significant impact on macroeconomic conditions.

4. Liquidity trap

This is a situation where consumers and firms hold onto money instead of spending or investing, even when interest rates are low. They keep the money in savings account as they believe interest rates may rise in the future, resulting in the prices of bonds (or goods and services) falling. This leaves monetary policy powerless and produces no effect on economic spending.

Characteristics of a liquidity trap include very low interest rates (almost 0%), and ineffective monetary policy. Other characteristics include a recession and deflation (Piper, 2012). In 1991, economic growth had begun to slow in Japan after the stock market crashed and this persisted until the country experienced deflation in 1995. The Bank of Japan set interest rates to 0.5% and the result was a liquidity trap.

Eventually, this grew into a credit crunch. Banks were unwilling to loan money because they needed to hold onto reserves to repair bank balance sheets after the losses they made when the stock and real estate markets crashed. One solution to this is bank restructuring. This is where public funds are made available to banks for restructure their balance sheets. This failed in Japan because banks were afraid to reveal hidden losses and didn’t want to lose control to foreign investors with vast financial resources. Japan’s problem continued for many years and shows how monetary policy can be inefficient or create more problems.

5. Monetary policy asymmetry

This is linked to monetary policy lacking the ability to target specific sectors but instead focuses on the unequal sensitivity of different industries to changes in the interest rate. For instance, the car industry is significantly affected by interest rates because many consumers rely on loans to purchase vehicles. Similarly, the housing market is highly responsive, especially for consumers with variable rate mortgages, where interest payments fluctuate according to the bank rate.

In conclusion, monetary policy is a critical tool for regulating nominal GDP and controlling inflation, as displayed in the 2008 Financial Crash and the COVID-19 Pandemic. Through mechanisms, such as interest rate adjustments and reserve requirements, central banks can influence consumption, investment and overall economic activity to meet macroeconomic objectives. However, the effectiveness of these decisions depends on multiple factors, such as the confidence of economic agents. Monetary policy also has limitations, including time lags and asymmetry in its effects. Despite its challenges, monetary policy is an essential mechanism for managing economies and supporting long-term growth.

Bibliography:

Ansari.S (2024) Expansionary Monetary Policy. Available at: https://www.economicsonline.co.uk/definitions/expansionary-monetary-policy.html/ (Accessed 12 January 2025)

Bank of England (2023) Our response to coronavirus (Covid). Available at: https://www.bankofengland.co.uk/coronavirus (Accessed 2 January 2025).

Bank of England (2024) Interest rates and Bank Rate. Available at: https://www.bankofengland.co.uk/monetary-policy/the-interest-rate-bank-rate (Accessed 29 December 2024).

Bank of England (2024) Official Bank Rate history. Available at: https://www.bankofengland.co.uk/boeapps/database/Bank-Rate.asp (Accessed 22 December 2024).

Bank of England (2024) What is inflation?. Available at: https://www.bankofengland.co.uk/explainers/what-is-inflation#:~:text=The%20Government%20sets%20us%20a,in%20line%20with%20our%20target (Accessed 2 January 2025).

Bank of England (2025) Monetary Policy. Available at: https://www.bankofengland.co.uk/monetary-policy(Accessed 9 January 2025).

Board of Governors of the Federal Reserve System (2013) Open Market Operations Archive. Available at: https://www.federalreserve.gov/monetarypolicy/openmarket_archive.htm (Accessed 26 December 2024).

Board of Governors of the Federal Reserve System (2024) Open Market Operations. Available at: https://www.federalreserve.gov/monetarypolicy/openmarket.htm (Accessed 26 December 2024).

Board of Governors of the Federal Reserve System (2024) Reserve Requirements. Available at: https://www.federalreserve.gov/monetarypolicy/reservereq.htm#:~:text=As%20announced%20on%20March%2015,requirements%20for%20all%20depository%20institutions(Accessed 9 January 2025).

CEIC (2024) European Union Reserve Requirement Ratio. Available at: https://www.ceicdata.com/en/indicator/european-union/reserve-requirement-ratio#:~:text=What%20was%20European%20Union’s%20Reserve,table%20below%20for%20more%20data(Accessed 9 January 2025).

Committee on Oversight and Government reform (2008) The Causes and Effects of the Lehman Brothers Bankruptcy. [Hearing Number 207], [110th Congress, Second Session], October 6 2008, U.S. Government Publishing Office. Available at: https://www.govinfo.gov/content/pkg/CHRG-110hhrg55766/html/CHRG-110hhrg55766.htm (Accessed 10 January 2025).

FAO (2022) Trade of agricultural commodities. 2000-2020. Available at: https://openknowledge.fao.org/server/api/core/bitstreams/d0751919-f100-4601-86f1-c35ab3a098f0/content(Accessed 5 January 2025).

Federal Reserve Bank of St. Louis (2020) Required Reserves of Depository Institutions (DISCONTINUED). Available at: https://fred.stlouisfed.org/series/REQRESNS (Accessed 10 January 2025).

Hayes, A. (2024) All about Fiscal Policy: What It Is, Why It Matters, and Examples. Available at: https://www.investopedia.com/terms/f/fiscalpolicy.asp (Accessed 6 January 2024).

Hayes, A. (2024) Liquidity Trap: Definition, Causes and Examples. Available at: https://www.investopedia.com/terms/l/liquiditytrap.asp (Accessed 6 January 2024).

Horton.M and El-Ganainy.A (n.d.) Fiscal Policy: Taking and Giving Away. Available at: https://www.imf.org/en/Publications/fandd/issues/Series/Back-to-Basics/Fiscal-Policy (Accessed 12 January 2025).

Lópex, M.Á (2024) The United Kingdom. Available at: https://www.europarl.europa.eu/factsheets/en/sheet/216/the-united-kingdom (Accessed 9 January 2025).

Office for National Statistics (2024) CPIH ANNUAL RATE 00: ALL ITEMS 2015=100. Available at: https://www.ons.gov.uk/economy/inflationandpriceindices/timeseries/l55o/mm23 (Accessed 22 December 2024).

Office for National Statistics (2024) Gross Domestic Product: a-on-q4 growth quarter growth: CP SA%. Available at: https://www.ons.gov.uk/economy/grossdomesticproductgdp/timeseries/ihyo/qna (Accessed 22 December 2024).

ONS (2024) CPI ANNUAL RATE 00; ALL ITEMS 2015=100. Available at: https://www.ons.gov.uk/economy/inflationandpriceindices/timeseries/d7g7/mm23 (Accessed 10 January 2025).

Pieper, L. (2012) Caught in a Trap: A Liquidity Trap in the United States. Available at: https://central.edu/writing-anthology/2019/05/31/775/ (Accessed 6 January 2025).

Reserve Bank of Australia (n.d.) The Transmission of Monetary Policy. Available at: https://www.rba.gov.au/education/resources/explainers/the-transmission-of-monetary-policy.html (Accessed 6 January 2025).

Schomberg, W. (2023) Explainer: Why is inflation so high in the UK?. Available at: https://www.reuters.com/world/uk/why-is-inflation-so-high-uk-2023-06-21/#:~:text=Britain%20has%20struggled%20more%20than,of%20Britain’s%20high%20inflation%20problem(Accessed 2 January 2025).

Trading Economics (2024) United States Fed Funds Interest Rate. Available at: https://tradingeconomics.com/united-states/interest-rate (Accessed 10 January 2025).

U.S. Department of Housing and Urban Development (2007) U.S. Housing Market Conditions. Available at: https://www.huduser.gov/periodicals/ushmc/winter06/q406_summary.pdf (Accessed 10 January 2025).

UK Parliament (2022) Oil Prices. Available at: https://commonslibrary.parliament.uk/research-briefings/sn02106/#:~:text=Oil%20prices%20jumped%20after%20Russia’s,of%20£103%20a%20barrel. (Accessed 2 January 2025).

UK Parliament (2024) Rising cost of living in the UK. Available at: https://commonslibrary.parliament.uk/research-briefings/cbp-9428/ (Accessed 2 January 2025).

Leave a comment